Tutoring tax deductions are now available thanks to the 2020 Louisiana Legislature Second Special Session, where lawmakers passed and the Governor signed Representative Edmonds’ HB 20, now Act 13, which gives tax payers a deduction up to $5,000 per child for in-person educational facilitators or virtual education facilitators (e.g., tutoring). This deduction under the new legislation is good only from March 13 to December 31, 2020.

Studyville CPA Gus Levy of The Levy Co outlined the legislation as follows:

- WHAT: Monies spent during the period March 13, 2020 through December 31, 2020 for educational coaching services for an in-person facilitator of virtual education (not paid to a family member) qualifies for a deduction on your 2020 Louisiana Income Tax Return.

- HOW MUCH: Actual expenses up to $5,000 per qualifying child up to your taxable income.

- WHO QUALIFIES: A dependent on your return who is enrolled in elementary or secondary school — either public or non-public.

This legislation is potentially beneficial to all families who purchase memberships, tutoring, or other educational services at Studyville during the time frame listed.

It is important that each family discuss their own tax situation with a licensed CPA to further understand how this legislation would benefit their particular family and tax situation.

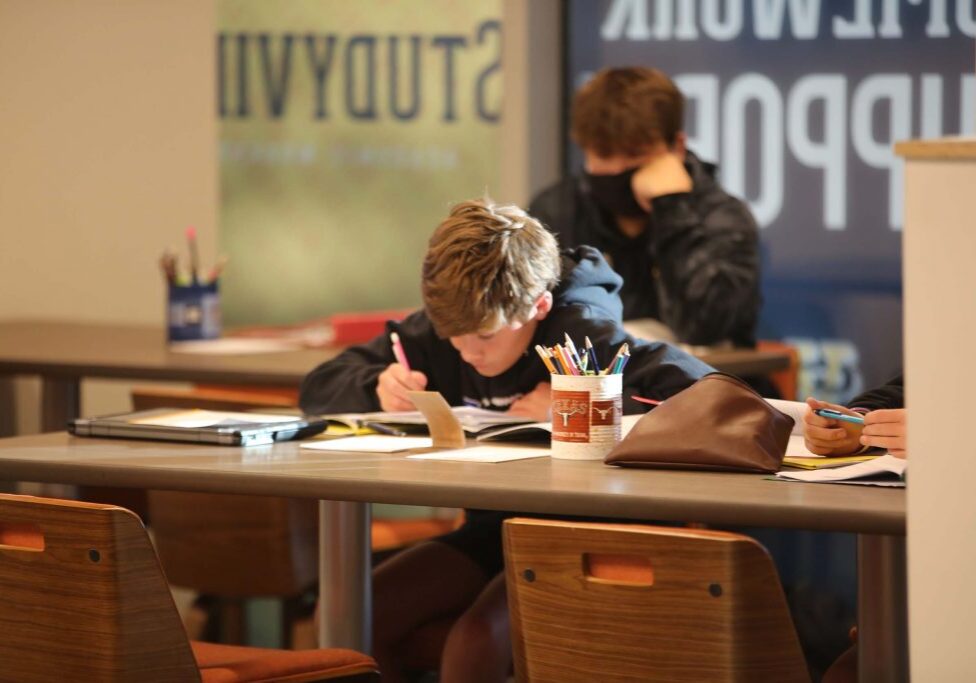

We appreciate the attention our state is giving to the strain COVID has left on our education system and families of school aged children. Studyville is committed to ensuring our students are not falling behind due to the pandemic to the best that we are able. We are here for our families, and are happy to discuss further should you have any questions.