Aside from getting married and buying a house, there is really only one other major financial decision a person can make that has the potential to alter their entire future.

College.

The financial cost is breathtaking: many state universities will now cost over $100,000 for four years. Private colleges are upwards of $300,000 for a four-year degree. If you have three kids, it could take fifty years to pay for college. The worst part? No one can really tell you how much college will cost. There is literally no way to really know what you will pay until after you go through a very laborious application process. Apply ED (early decision), and you are committing to going to that school even if they do not+ offer you a scholarship.

Here are some little known facts about affording college:

-

89% of students at private universities get a need-based or merit-aid discount. Do you really want to be in the 11% who pays the full price?

-

FAFSA, a complicated application for need-based scholarships, has a formula that assumes you will only use 5% of your 529 for college tuition. Why? They want to encourage you to save for college, so don’t believe the lies that you shouldn’t be saving for college if you want a chance at need-based scholarships. Put as much as you can into 529s; Louisiana has a great one.

-

Colleges will look at your home equity when considering financial aid scholarships. Creepy? Yes.

-

A major award! Merit discounts are bountiful and akin to the leg lamp from A Christmas Story. People are super proud of them, but in reality, colleges have figured out that if they name small scholarships and give them away like candy you’re more likely to be drawn in. Giving you $2,000 off a $300,000 education sounds way better when it is the “Meritorious Ancient Knights of Honor Scholarship.” Looks great on a job application, right? Don’t be fooled by letting this tactic pull you into a college that isn’t right for you.

-

The higher the tuition, the higher the discount. The geniuses of higher education have decided a $70,000/year sticker price makes them sound more elite. Few people can afford it, so they discount it on a case-by-case basis (no one can tell you how much. It varies from person to person, hence the need to look at your home equity and other creepy things). More people get discounted, so more people apply. The higher the sticker price the more elite they seem, so more people apply.

“I struggle with two things: How damn complex the financial aid application process is on the FAFSA side and how much the system asks of each family. I have an MBA. I was senior vice president at the second largest savings bank in the country. I couldn’t figure out FAFSA the first time I tried, and that is not right.”

–Katharine Harrington, Former USC Vice President of Admissions

If you bought a $300,000 house, chances are you would hire a real estate agent to help you find out if the house has mold or is in a flood zone or whatnot. That agent would help protect your interests. It’s the same with college; most people need help.

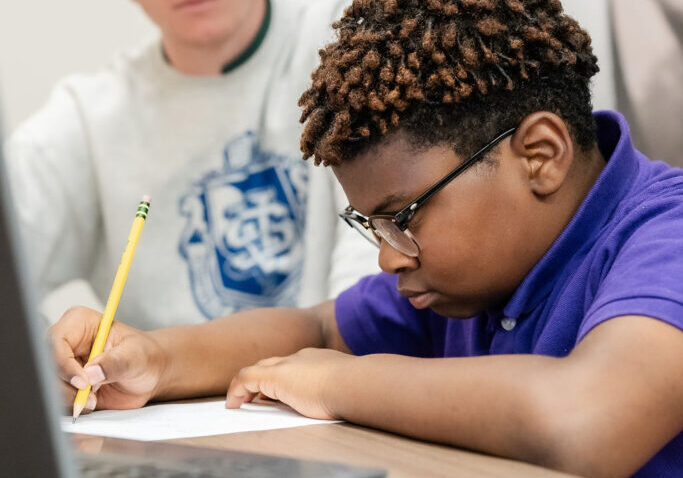

Studyville has the college admissions counseling help you need to ensure you are making the right financial decisions for college. Even if you are looking to attend a state school, we can help you get all the applications (including FAFSA) in order so you can breathe easier with an advocate at your side. College counselors are available with appointments here or by calling us at (225) 408-4553 anytime.

This week, Studyville is having “College Week” with recruiters from TCU, Rollins, Clemson, Hillsdale, and LSU. Even if you can only attend one of the classes, it will be well worth your time. Sign up at Studyville or call us at (225) 408-4553 to reserve your spot.

Here’s to getting many major awards!